EURUSD braces for fresh yearly low ahead of key events/data

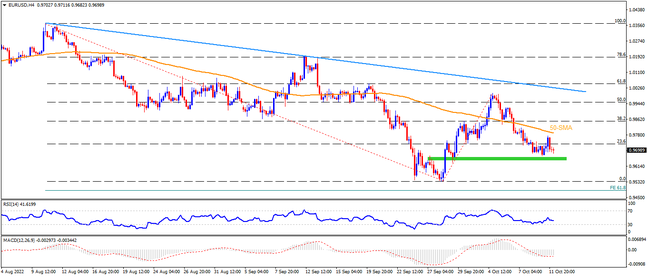

EURUSD bears take a rest around the two-week-old horizontal support area while waiting for this week’s key catalysts, namely FOMC Meeting Minutes and US CPI. That said, sluggish RSI and bearish MACD signals join the quote’s sustained trading below the 50-SMA to keep sellers hopeful. However, a clear downside break of the 0.9665-50 region appears necessary for the fresh leg down. Following that, the latest multi-year low, marked in September around 0.9535, will gain the attention ahead of the 61.8% Fibonacci Expansion (FE) of August-October moves, close to 0.9485. In a case where the pair remains weak past 0.9485, the odds of witnessing a slump toward the September 2001 high near 0.9330 can’t be ruled out.

Alternatively, recovery moves need to cross the 50-SMA level of 0.9800 for the start. Following that, the 50% Fibonacci retracement of the August-September downside and the monthly high, respectively around 0.9950 and the 1.0000 psychological magnet should lure the EURUSD buyers. If the quote remains firmer past 1.0000, a two-month-old downward sloping resistance line, around 1.0025 by the press time appears the last defense of the bears.

To sum up, EURUSD appears bearish ahead of this week’s important data/events.