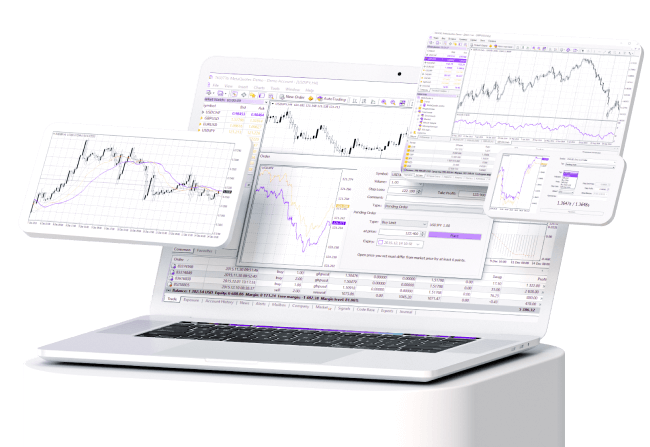

MetaTrader 4 Supreme Edition advantages

Mini Terminal

Enjoy fast and simple trade management, with our Mini Terminal. Use it to quickly open and easily manage your Forex trades.

Download PDF

Trade Terminal

Trade Terminal is your personal trading assistant. It combines Mini terminal features and other functionalities for smooth trade management.

Download PDF

Tick Chart Trader

Seeing every price movement means you can quickly find the best entry or track price action. Use Tick Chart Trader for simplified chart tracking.

Download PDF

News Feed

Connect with our daily news feed directly in MT4 and experience the edge with real-time trading analysis.

Download PDF

Indicator Solutions

Get highly advanced indication tools for experienced users. Keep track of your order history, get access to trading signals and benefit from in-depth charts.

Download PDF

Mini Chart

A time-saving indicator, that shows you small charts inside your main chart. Previously unavailable multiple timeframes and chart types, now included.

Download PDF